Money is invested into an account earning 4.25 – Money invested into an account earning 4.25 presents a unique opportunity to explore the intricacies of investment and its potential to enhance financial well-being. This comprehensive guide delves into the fundamental principles of investing, examining various account types, interest rates, and investment strategies to empower individuals with the knowledge necessary to make informed financial decisions.

Throughout this discourse, we will uncover the significance of understanding investment vehicles and their associated risks, gaining insights into the historical evolution of investment practices, and identifying common investment strategies employed by successful investors. By delving into real-world case studies and examples, we aim to provide a practical understanding of the factors that contribute to both successful and unsuccessful investments.

1. Overview of Investment Principles: Money Is Invested Into An Account Earning 4.25

Investing involves allocating funds to assets with the expectation of generating future returns. It offers potential benefits such as capital growth, passive income, and long-term financial security.

Understanding investment vehicles and their associated risks is crucial. Stocks, bonds, mutual funds, and real estate are common examples, each with its unique characteristics and potential rewards and risks.

The history of investment practices dates back centuries, with evidence of early forms of banking and lending in ancient civilizations.

2. Account Types and Interest Rates

Account Types

- Savings accounts: Offer low returns but high liquidity and safety.

- Checking accounts: Provide easy access to funds but typically have low interest rates.

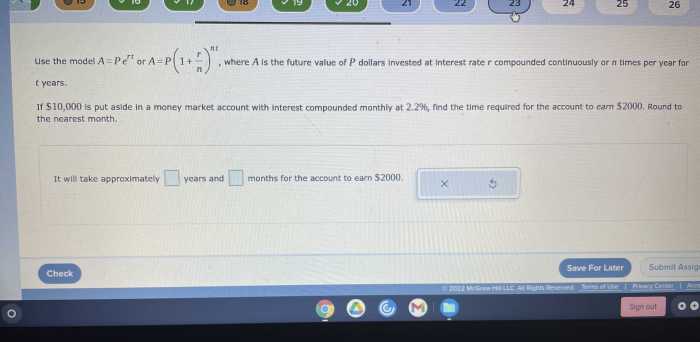

- Money market accounts: Combine high liquidity with higher interest rates than savings accounts.

- Certificates of deposit (CDs): Offer fixed interest rates and terms.

- Retirement accounts (e.g., IRAs, 401(k)s): Provide tax advantages for long-term savings.

Interest Rates

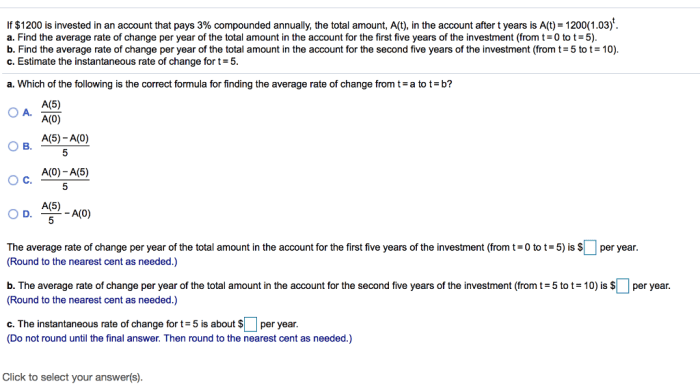

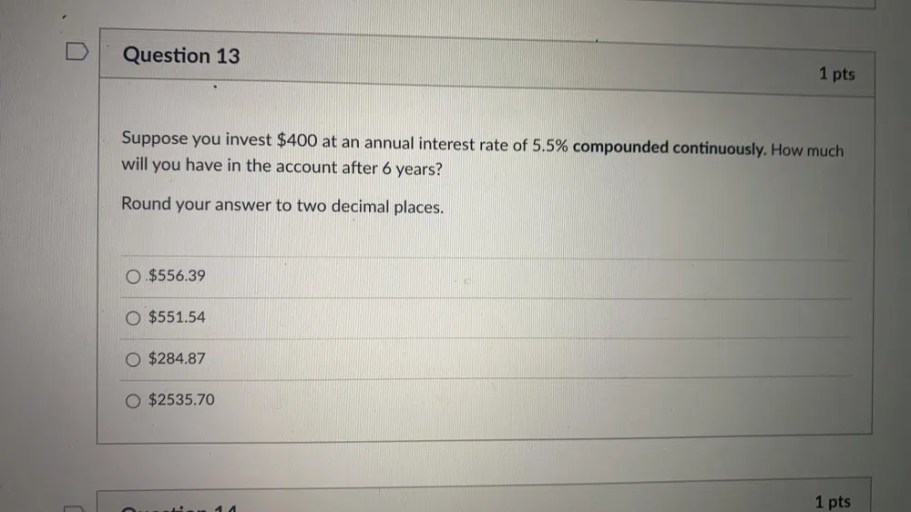

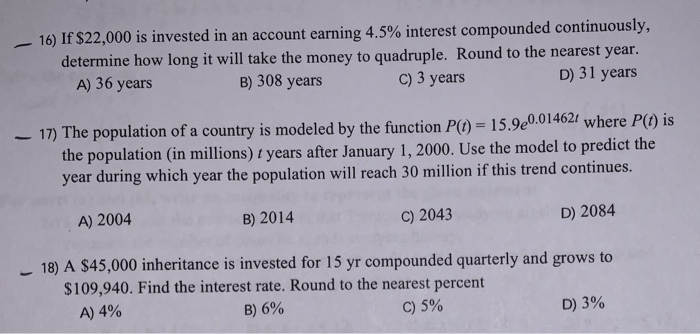

Interest rates are the percentage charged on borrowed funds or paid on invested funds. They significantly impact investment returns, with higher rates leading to increased earnings.

Compounding Interest

Compounding interest is the interest earned on both the principal and the accumulated interest. Over time, this can result in substantial growth in investment value.

3. Investment Strategies

Diversification

Diversification involves spreading investments across different asset classes and sectors to reduce risk. It mitigates the impact of market fluctuations on a single asset or industry.

Asset Allocation

Asset allocation refers to the distribution of investments among different asset classes based on an individual’s risk tolerance and financial goals.

Matching Strategies to Risk Tolerance and Goals

Investment strategies should align with an individual’s risk tolerance and financial goals. Higher risk tolerance allows for greater potential returns but also increased volatility, while lower risk tolerance requires more conservative investments.

Successful Investment Strategies

Historical examples of successful investment strategies include value investing, growth investing, and momentum investing.

4. Impact of Inflation and Taxes

Inflation

Inflation erodes the purchasing power of money, reducing the real value of investments. Investors should consider inflation when making investment decisions.

Taxes, Money is invested into an account earning 4.25

Taxes can significantly impact investment returns. Understanding the tax implications of different investment vehicles is essential.

Mitigating Inflation and Taxes

- Investing in inflation-linked bonds or real assets.

- Utilizing tax-advantaged accounts (e.g., IRAs, 401(k)s).

- Rebalancing portfolios regularly to maintain desired asset allocation.

User Queries

What are the benefits of investing money into an account earning 4.25?

Investing money into an account earning 4.25 offers several potential benefits, including the opportunity to grow your wealth over time, outpace inflation, and secure your financial future.

What are the different types of investment accounts available?

There are various types of investment accounts available, each with its own characteristics and benefits. Some common types include savings accounts, money market accounts, certificates of deposit (CDs), and brokerage accounts.

How do interest rates affect investment returns?

Interest rates play a crucial role in determining investment returns. Higher interest rates generally lead to higher returns, while lower interest rates can result in lower returns.